Do you want to access to this and other private contents?

Log in if you are a subscriber or click here to request service

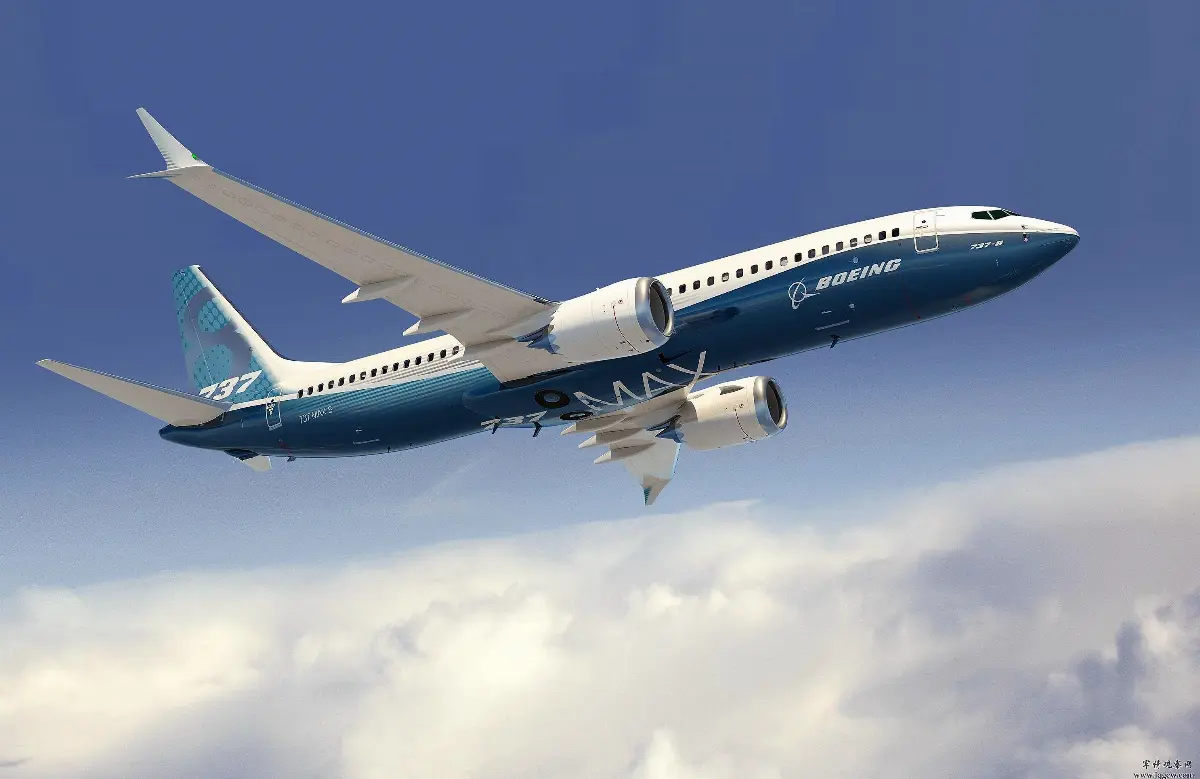

Airplanes-helicopters. Boeing reports fourth quarter results

The data for business segment

The Boeing Company reported fourth-quarter revenue of $14.8 billion, reflecting higher commercial volume and lower defense revenue. GAAP loss per share of ($7.02) and core loss per share (non-GAAP) of ($7.69) reflect lower charges and higher commercial volume. Boeing recorded operating cash flow of $0.7 billion. Operating cash flow improved to $0.7 billion in the quarter, reflecting higher commercial...

red - 1241859

AVIONEWS - World Aeronautical Press Agency

◄ Previous page

AVIONEWS - World Aeronautical Press Agency