Do you want to access to this and other private contents?

Log in if you are a subscriber or click here to request service

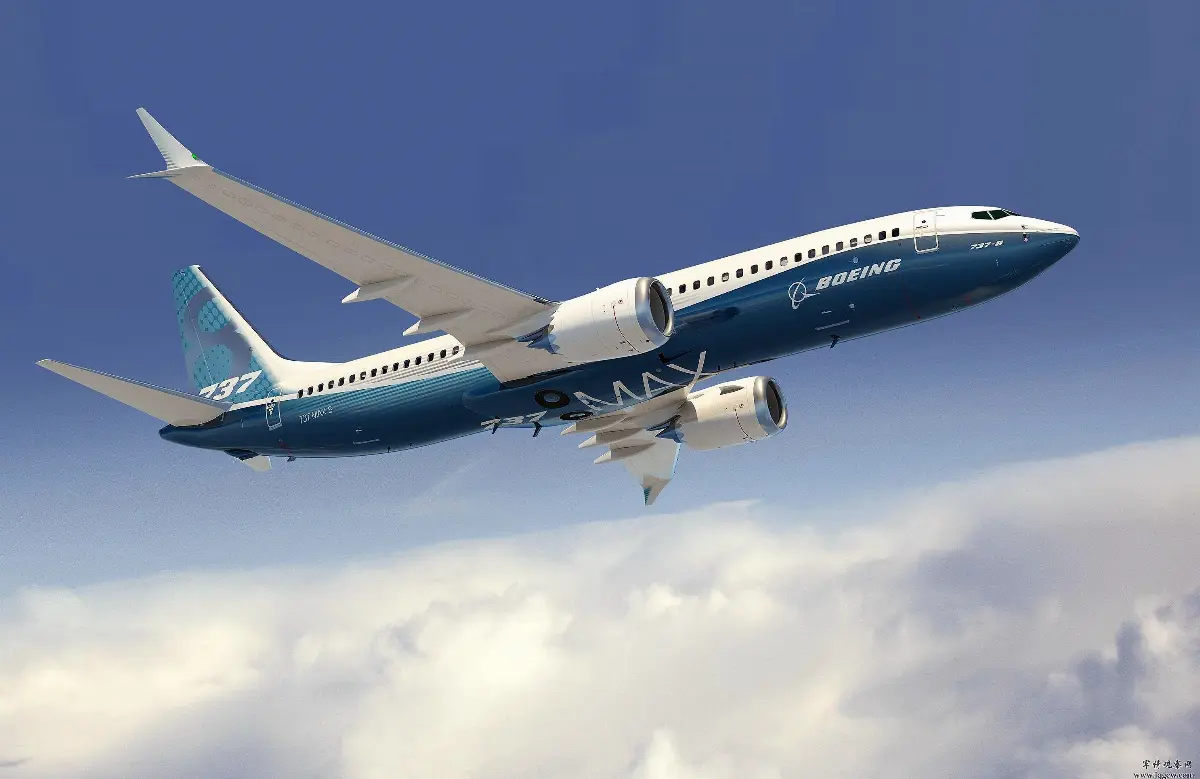

Airplanes and helicopters. Boeing reports 3Q results

The highlights

Boeing reported third-quarter results.The highlights:Continued progress on global safe return to service of 737 MAX aircraft and focus on operational stabilityRevenue of $15.3 billion, GAAP loss per share of ($0.19) and core (non-GAAP) loss per share of ($0.60)Operating cash flow of ($0.3) billion; cash and marketable securities of $20.0 billionCommercial Airplanes backlog of $290 billion and added...

red - 1239966

AVIONEWS - World Aeronautical Press Agency

◄ Previous page

AVIONEWS - World Aeronautical Press Agency